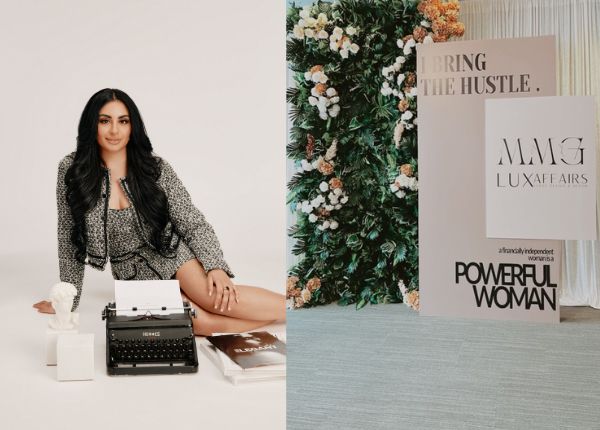

Meet Gina Judge, the visionary force behind The MMG, a dynamic financial literacy company and podcast that empowers women to stride confidently towards their financial aspirations. As the owner and founder, Gina’s mission revolves around equipping women with the tools and knowledge to chart their own paths to independence through financial education.

With a steadfast belief that a woman’s financial future should be self-determined, regardless of the presence of influential men in their life—be it a father, brother, or partner—Gina and her team at The MMG are dedicated to fostering financial autonomy. The approach taken by The MMG is holistic and comprehensive, covering a spectrum of essential topics including budgeting, adept debt management, credit cultivation, investment strategies, insurance know-how, mortgage eligibility, and beyond. This well-rounded education is perceived as the cornerstone enabling individuals to embrace a life enriched with financial abundance and countless prospects.

Tell us about your journey? How did you get involved in your industry?

I’ve worked in the finance space for 7 years.The spark for my business was ignited during the pandemic when I witnessed the staggering number of individuals caught off guard by unforeseen emergencies. I started creating financial content that anyone in the world could access for free. When so many people were struggling financially, I wanted to give them hope that it wouldn’t be their ‘forever,’ and that they could indeed take actionable measures towards a stronger financial future.

On a personal scale, I struggled financially in my early twenties, I grew up in a strict Punjabi household. My step-father was an abusive alcoholic, and at 18 years old, I made the decision to move out of my toxic household. This was a decision I made in the heat of the moment and although it was the best decision from a mental health standpoint, it was detrimental to my financial health. When I moved out, I continued to manage and spend as if I was living at home with minimal expenses, I was financially supporting myself while paying for post secondary education, and eventually I ended up in credit card debt, ruined my credit score, and depleted my savings. The turning point? I started working for a financial institution. After becoming educated on money, I began to view it as a tool that could help me get ahead. Eventually, I became debt-free, built an excellent credit score, started investing and purchased my first property. When I was struggling I had no one to turn to, I started The MMG because I want to be that person for other young women.

What is the hardest challenge you have come up against in your personal/professional life? What was your biggest lesson learned?

Today, I’m committed to helping women remove themselves from environments that don’t serve them. I am committed to helping you evolve into the best version of yourself.

The biggest lesson I’ve learnt is that in life, we often hold on to things that aren’t helping us elevate to the next level. We hold onto relationships, friendships, jobs and even bad habits that don’t serve us. We do this because we fear the unknown. We fear that by making change, we will lose ourselves and not know how to move forward. The truth is when you make a conscious decision to let go of the things that no longer serve you, you evolve.

What advice would you give South Asian women wanting to do what you do?

My advice to South Asian women wanting to enter the financial space is to just do it! Finance is such a male dominated space, there aren’t enough women of color in this industry. If you want to start a business similar to mine, I recommend investing in a mentor and taking calculated risks. Sky’s the limit!

What does “women empowering women” mean to you?

Women empowering women to me means understanding that sharing a resource with another woman, lifting her up, sharing words of encouragement, doesn’t take away from the blessings coming my way. Under The MMG, I’ve started building a community of ambitious women, connecting them, so that they can network amongst themselves and support one another in their entrepreneurial journey. I also don’t gate-keep, when I mentor my clients, I openly share my knowledge and systems because I want them to succeed in their line of business.

If you could tell your teenage self something, what would it be?

I would tell my teenage self that if it isn’t going to matter 5 days, 5 weeks, or 5 months from now, don’t spend another 5 minutes worrying about it. The amount of time and energy I spent worrying about things that were out of my control is unbelievable. As an adult, I recognize what situations are worth investing time and energy into.

What is your personal motto or mission statement?

My mission statement is that a financially independent woman is a powerful woman. My purpose in life is to draw out of others the best version of themselves and I keep this at the forefront with my clients, my friendships, and also my relationships.

Besides your work, what are you passionate about?

I am passionate about traveling, I feel like I lived my entire life in flight or fight mode, and I’ve finally built a life where I can travel and focus on the things that matter to me. The world is such a big beautiful place and I want to experience as much of it as I can!

Where can one find you on your days off?

You can find me by the beach or downtown spending time with my loved ones! Over the last two years, I’ve traveled once a month and I usually work remotely while traveling. When I am in town, I love venturing out to Yaletown with my girlfriends.

How do you balance work, life, family?

I’ve built time management and project management systems, I religiously use my google calendar and everyday I make time for self development, business development and my loved ones.

Upcoming Project/Events

Every other month I host a masterclass via zoom where I teach students how to build wealth by educating them on investment options. In this class I cover how to set investment goals, assess risk tolerance, how to effectively utilize a TFSA, RRSP, RESP, and the new FHSA account. I educate my students on how they can use the stock market to save for major milestones like their wedding, real estate purchase, child’s education, and retirement!

On Sunday, October 8th I will also be hosting an in-person financial literacy seminar in the lower mainland.

I’m also onboarding for my

MMG mentorship program, each quarter I work with 10 ambitious women where I put them through an intensive curriculum. This program teaches them the fundamentals of building wealth, my goal is to help my clients get to millionaire status in their lifetime, sooner than if they tried to do it on their own. Many of the women who’ve graduated from this program launch successful businesses, purchase real estate, create multiple streams of income but more importantly lead abundant lives where money is the last of their concerns!